Adult Education & Monetary Theory

"Keep Cash Alive!" means improving knowledge about budgeting skills and reducing debt - but how? Some useful resources to share.

This weekend I had a conversation with a market stall-holder who had been told by her boss that she couldn’t accept cash for a trade. I was tempted to walk away, but the stall-holder explained she had tried to persuade her boss that it was crucial to ‘Keep Cash Alive’ but that apparently he couldn’t see the wider picture. There was also a trust issue. I wasn’t surprised.

As a freelance adult tutor, I’m often asked to deliver sessions on ‘budgeting skills’. And I’m always amazed by the general lack of understanding, and genuine curiosity in the day-to-day factors of managing our money here in New Zealand. Having never (so far as I can remember, anyway) been formally ‘taught’ budgeting skills, I had to learn through experience. But finding unbiased resources is not easy!

Why is there (virtually) no monetary theory taught in schools and what can we do about it?

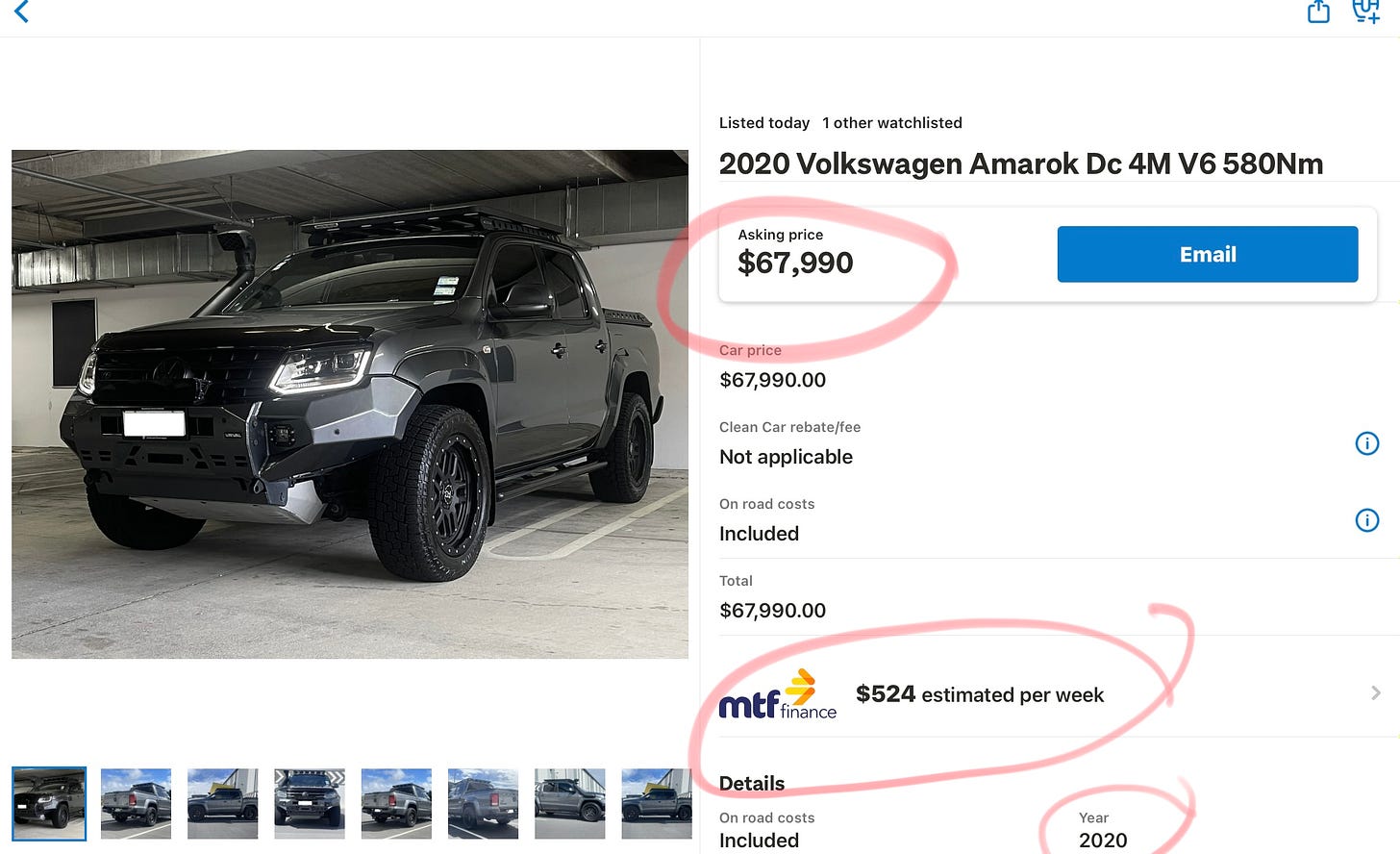

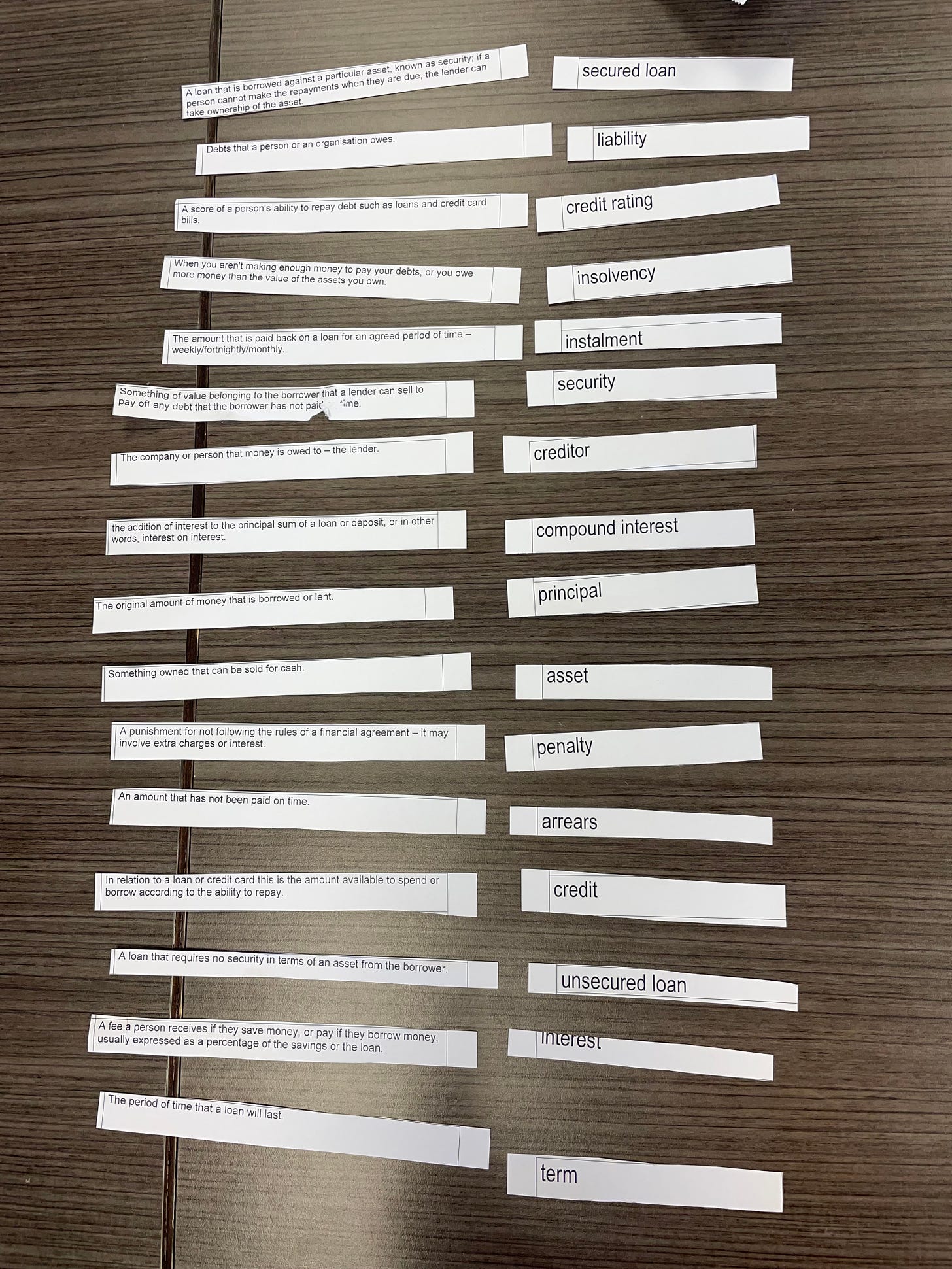

Facilitating a short session on basic budgeting skills is pretty simple. Depending on the needs and size of the group, it can vary from a modified Monopoly board game, to a spreadsheet exercise. And I make it as practical as possible. In the workplace-type sessions, eg with manual labourers, we usually start with a copy of the local paper, or Trademe advert (NZ’s quaint equivalent of Ebay). I ask a student to volunteer to play the role of ‘Banker’, then each student gets an imaginary ‘redundancy package’ or a budget to consider how to prioritise their outgoings/spending. We imagine they need a new car, and we do the maths for a potential loan. For example:

Differentiation means we can use various scenarios of cars, expenses, insurance costs, interest rates, deposits and length of payments etc….

…then we calculate the following aspects of their personal loan (you can try this with friends and family):

How long will your loan take to pay off?

Where will you be when the loan ends?

If you wanted to clear the loan early, what fees are involved?

What will the vehicle be worth when you have paid it off?

On completion of the laond, how much have you paid in total for the vehicle?

This stimulates lots of discussion. By the end of the session, usually the emotions from many of my students are shock and disbelief, but also resolve – to be ‘more careful’ with their commitments next time. They often also state they will pass on this insight to their friends and family.

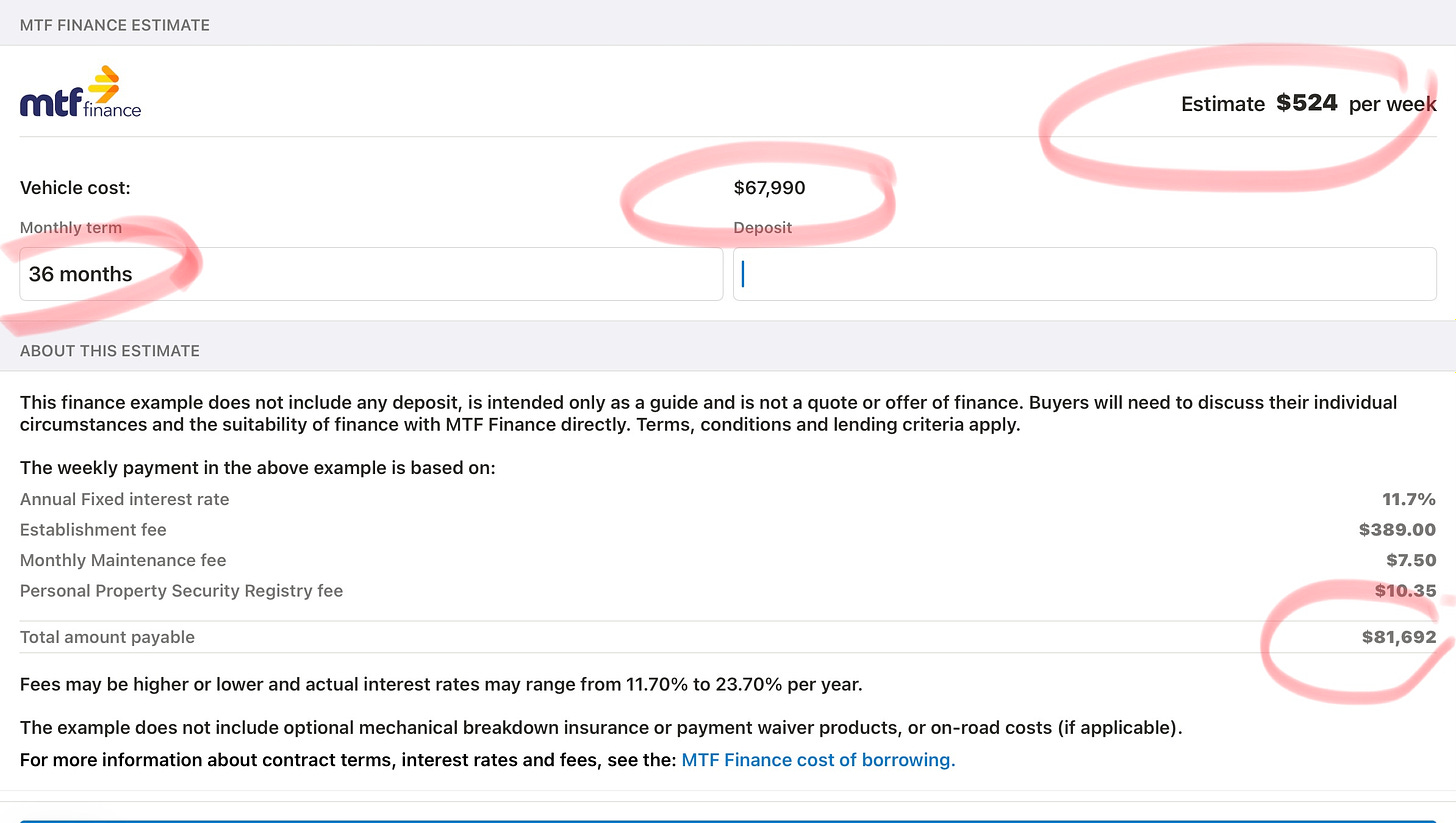

There’s also the issue of language used, and here’s an image to show an example of a lesson involving discussions around financial terminologies (did this student match them all up correctly?):

Fun, eh?! ;)

Raising awareness helps, but what about the wider societal issues of money and debt? How can we address this massive gap in knowledge about where these (paper)-loans come from in the first place, and the benefits of being debt-free?

Over recent times, I have been intrigued by the numerous helpful articles and docos that could be included into these types of workshops, to build a wider knowledge-base of this topic. I thought it would be useful to post some of these here, for further development into our developing parallel communities.

So here is where I started, after hearing about Paul Grignon’s ‘Money as Debt’ mentioned on a Delingpod – a one-hour animation with some funky music from over ten years ago. Still relevant today and with further updates and resources on his website too:

Some context: to obtain a ‘mainstream’ context of the concept of economic ‘deficit’ from a few years ago, see Stephanie Kelton’s TedTalk (approx 15 mins)

There are useful articles and books, but I find many are too ‘heavy’ for an introduction to the topic. But Michael Sandel’s What Money Can’t Buy: the moral limits of markets could be a useful additional resource to provide extracts from? There are some great examples of corruptions of different markets here:

There’s also the very readable, personal account from an ex-banker, David Rogers Webb, (free eBook) The Great Taking. Now also available as an hour-long narrated doco, too (highly recommended).

Independent US-based Hillsdale College provide a free online course on Economics, for those who want to delve into these questions more deeply (out-of-date, but still useful).

The brilliant UK researcher Ivor Cummins posted an excellent summary of the Military-Industrial Complex: Are all wars, banker’s wars? Which originally comes from Michael Rivero / Zane Henry here at https://whatreallyhappened.com/

Then more recently, the excellent Corbett Report: published How Blackrock Conquered the World, which includes up to date info on the way that AI could be weaponized against us, through the harvesting and manipulation of our data.

To zoom out for the global context of how this (debt) data is used and why, I highly recommend this 10 min animation from educationalist Alison McDowell’s research ‘Wrench in the Gears’ into the 4th Industrial Revolution and the impact investment firms which profit from poverty:

How can we (educationalists, parents, community leaders) help to ‘Keep Cash Alive’? How can we awaken others’ critical thinking about ‘studying economics’ toward a more practical everyday awareness of budgeting and authentic sustainable use of ‘money’ (in its broadest sense)? Please share your ideas and comments below.