"Farming the Oldies": Our 'Right to Occupy' (this Earth?) and the Covid Era

"You'll own nothing and be happy": retirement homes as wealth transfer, run by individuals in those ever-revolving doors between Government, Commerce and Public Private Partnerships.

**This week’s post topic wouldn’t have even been on my radar, unless three individual and completely unconnected subscribers hadn’t contacted me with various bits of this jigsaw. Their names are not included to protect privacy and confidentiality. I am very grateful to you all.**

The normalisation of Schwab’s famous Great Reset mantra “You’ll own nothing and be happy.” is already all around us. For instance, remember that Uber that got you home from the pub? Or that ‘essential product’ like a carpet-cleaner you hired last weekend that you couldn’t justify buying for that (frustratingly re-occurring) ‘one-off’ project? But there’s a broadening, creeping reality to this global land grab, wealth transfer and asset-stripping by impact investors. And it’s something many of us drive past often, yet don’t fully recognise how symbolic it is to our dystopian era. And is it a coincidence that some of the same names from our tyrannical NZ Government covid era, reappear in this investigation?

Here’s my first attempt at researching this topic, and it really is a rabbit hole:

Residential ‘care homes’ in New Zealand.

If you aren’t yet familiar with this global phenomena, then this comprehensive exposé from Politico last year, detailed a case study of Atrium, a residential ‘home’ in Wisconsin, USA, that eventually went bankrupt. It’s a longish read, but well worthwhile to get a handle on some of the complex web of legal ambiguities and financial agreements these kinds of ‘homes’ are a part of. And the inhumane treatment some residents suffer.

But wait! “These units are like luxury hotels!” ‘thousands of happy residents’ claim. You get access to all kinds of marvellous services, like full-size heated swimming-pools, hot spas and hairdressers. Blimey, you may even be able to bring your own furniture, and your beloved pet. Look at that contented woman in the image above, for example, wearing her glittering jewellery and sipping her sundowner cocktail, companion dog on her lap. Paradise I tell you! Lifestyle choices like these are wonderful opportunities, right? They allow older people to be ‘relieved’ of that worrisome ‘burden’ of owning a property. They can retire in security, safety and style, inside a community of likeminded people, with professional modern healthcare on-hand when they need it, entertainment and education options and visitors whenever they like.

Let’s do a reality-check on that propaganda. Below is an example of a ‘wholesome’ meal that a resident (let’s call her ‘Jill’) at a Summerset home was served-up, almost everyday, twice a day for lunch AND dinner, for a whole year before she tragically passed away:

Like many dismayed relatives of vulnerable residents, Jill’s son complained repeatedly to management about the appalling standards of care and poor nutrition provided for his mother. To no avail. This unappetising plate would rarely include any fresh vegetables or fruit. Some elements were literally inedible, with no meaningful protein content. Another subscriber with inside information about the catering at these institutions, tells me the contractors often have a budget of only NZ$5 per day for each resident’s meals. Nutrition on a budget like that isn’t impossible, but takes time and creativity that I suspect aren’t prioritised at companies like Summerset?

The logical conclusion would be policies at these institutions do not value human life. But are they really facilitators of a population ‘cull’ and massive wealth transfer? Let’s dig a little:

These gated-community institutions, sold as ‘independent living opportunities’ or even utopian ‘villages’, are financial investments for global private equity firms, which are – as one subscriber described it ‘farming the oldies’. To be clear, most units at these institutions are not rented, and not bought - they are ‘occupied’ for a sum equal or larger to a freehold purchase price. Plus fees. This is exploitation of our older-generation’s assets (and their families’ potential inheritance) in potentially unethical and sometimes devious ways. As the by-line to the above Politico article explains:

“Advocates for elderly people say loans from private lenders are enabling nursing-home operators to take cash out of their homes, jeopardizing their finances.” (and their lives, too, it should say).

And also from that article:

For many advocates for elderly people and their families, Atrium’s fall demonstrated how private equity firms and their affiliated lenders, in the pursuit of profit in America’s growing nursing home industry, are speculating in a way most traditional banks will not. Fledgling entrepreneurs, the advocates note, have taken advantage of their lenders’ largesse to expand and build precarious empires — often while enriching themselves.

The relationship between lender and nursing home operator is symbiotic, with each feasting off of the steady stream of fees from Medicare, Medicaid and private insurers. That has left vulnerable residents — elderly people nearing the ends of their lives — at risk of being displaced when the empires crumble. State taxpayers are often left to pick up the pieces.

But this isn’t restricted to the USA. To give you an idea of size of this sector in NZ, here is an excerpt from a recent Submission from the Retirement Villages Association (RVA) (members of which represent 96% of the sector):

“More than 50,000 Kiwis now call a retirement village home and approximately 100 older New Zealanders are choosing to move to a village every week. This is around 14% of the +75 population, a figure that has been stable for the last four years. There is no doubt that New Zealand’s population is ageing quickly. Between today and 2043, people aged 75+ will increase from around 383,510 people to 759,630 – almost double. Based on a market share of 14%, that means that by 2033, almost 80,000 people will be living in a village, and by 2048, that figure will increase to 116,600 people. To meet the demand for retirement villages, the retirement village industry has built on average for each of the last five years 1,854 units. Today, there are 95 villages in the development pipeline with the capacity to deliver 24,770 units over the next five or so years. The growth is not confined to the main centres – it is spread across the entire country so that all regions have the opportunity of a retirement village nearby.” (my emphasis)

The total industry investment is approaching $106 billion according to the RVA, which is >32,000 retirement village residents. The scale and reach is pretty astounding. Here is an aerial view of another new Summerset development locally:

Rather than ‘symbiotic’ I would use the word ‘parasite’. During the height of the housing boom, retirement villages in NZ have increased 79% since 2012, leading to the six largest retirement home operators becoming:

Ryman Healthcare, Metlifecare, Summerset, Bupa, Oceania, and Arvida. These groups manage approx. 48% of homes throughout the country, and 65% of the units (according to RVA’s annual report). Ultimate Care Group (UCG) is another large provider, with over 20 institutions throughout NZ. And we’ll return to that company in a moment.

Some reasons why the industry has grown in recent years, include:

$billions in income from (until now) enormous increases in land/property values;

“copy and paste” model - build it and they will come!

low-paid, highly transient, casual front-line (temporary) staff (often from overseas);

a constant stream of funding from taxpayers via Government ‘budgets’,

NZ population has a large percentage of elderly, many are wealthy, retired skilled migrants.

Excess all-cause mortality could benefit these institution’s investors. Let me explain why…

Right to Occupy = wealth transfer

Under a ‘Right or (Licence) to Occupy’ agreement, (legally an Occupational Right Agreement, ORA), a resident’s home unit is not rented. In a complex web of contracts with various fees, the ORA purchases the contractual right to occupy a property, but with no legal ownership of the property itself or the land. An ORA is not a residential tenancy and is promoted as a way of living without ‘the burden’ of property ownership and worrying about the potential need to sell the property someday. “You’ll own nothing, and be happy” How convenient.

Here are some typical characteristics of a Licence to Occupy:

You have a contractual right to live in the unit (or villa, apartment, etc.) for as long as you choose.

An ‘outgoings’ fee (usually monthly) entitles use of various communal facilities, services and amenities offered by the retirement village.

No capital gains is likely after the licence to occupy ends.

You can’t borrow against the value of the unit, although in some cases the operator may permit you to borrow against the termination proceeds you will be entitled to when the licence ends (see below).

Upon termination of your licence to occupy, the retirement village operator typically assumes the responsibility of finding a new resident for your unit.

When a resident’s contract is cut short, a Power of Attorney could need to sacrifice a large percentage of the estate (‘termination proceeds’) because the onward sale price of the ‘Right to Occupy’ is reduced significantly to cover ‘admin’ and ‘service’ fees. This could be called a “Deferred Management Fee” and is sometimes not clearly stated or understood, by the retiree or their families. There is also a specified time period that the Occupational Right Agreement (ORA) has to be completed. (I noticed in the Summerset flyer posted above, the ‘time to sell’ has been extended to 6 months, because of the economic downturn). Residents of early units probably had no idea about the size and scale of their pseudo-landlord’s expansion plans I summarised above. But inevitably, as swanky modern units are built, older units look less attractive, and values drop further. Units unsold after a specified timeframe incur further costs to the retiree’s estate. (For those interested, interesting legal details about the NZ situation available here). Higher turnover of residents = increased profit.

So what? I hear you say.

These commercial companies which, like the US example in the Politico article linked above, harvest vast amounts of taxpayers’ funds that could be used – perhaps more efficiently - for other public healthcare provision. The ambiguity between public and private purposes and funding means little transparency, which is why Schwab’s Great Reset describes Stakeholder Capitalism (Communism). I’ve written about the problem with these PPPs in education extensively in posts about the one impact investment entity, Legatum, for example here and here. If you’re unsure what I mean by impact investor, please see this post.

Returning to the Ultimate Care Group they provide different sites (including ‘villages’) throughout the country for either ‘independent’ or ‘assisted’ living, depending on the individual’s needs (that are, apparently, regularly ‘assessed’ (at a cost)). For example:

Shareholders of Ultimate Care Group are UCG Investments Ltd and share Director, Ben Unger. And the main shareholder of UCG Investments is Windhaven Care Holdings Ltd, a private equity firm, which again, have familiar names as Directors. Windhaven Investments Ltd owns eNurse Australia and other agencies involved with healthcare recruitment. How convenient. Clime Asset Management Ltd shares an address, which although has an NZ Companies registration, seems to be an Australian-based company? I don’t have time to go into depth with this topic here, suffice to say this is a multi-company, multi-investment, multi-stakeholder entity, which likely holds its shareholders’ profits above residents’ personal needs. And on that subject….

A quick look at some of the audit reports from the Auditor for the NZ Ministry of Health for these establishments, overseeing (for example) compliance with the Health and Disability Services Standards. These - perhaps unsurprisingly knowing what we now know - provide some quite shocking outcomes. For instance, in this randomly selected one from Aug 2023, the inspectors found prior informed consent was lacking for some dementia patients and their families who apparently unknowingly were on the equivalent of a Do Not Resuscitate order. Furthermore, the report states:

“evidence of police vetting, and a signed employment agreement was inconsistent. The sample size was increased to nine and demonstrated that four of nine files did not evidence a police check, and seven of nine did not have a signed employment agreement.”

Institutions like this not conducting a police check on their staff is unacceptable. It leaves vulnerable, elderly people liable to all kinds of exploitation, financial, physical and emotional.

A look at the ‘Customer Feedback’ reports from what maybe I could term the Retiree Exploitation Industrial Complex provides confirmation of the depressing numbers of complaints about the appalling standards in the sector. But that data is for another post.

UCG and another revolving door

I’ve written about the revolving doors of power, which highlighted how some individuals, senior in the NZ covid era Government ‘response’, later went on to be appointed to senior roles in commercial companies which benefited financially from that NZ covid era ‘response’. For instance, through some ‘staff’ being awarded rare-as-hens-teeth exemptions from the ‘no jab, no job’ policy.

Let’s look at another of the senior roles within the then-NZ Gov’s covid era response. The ‘Chief Advisor’ (no less) for the ‘NZ Covid National Coordination Response’ (May 2019- Jan 2022 - according to her Linkedin profile). Lucy Adams went on to work for another Government dept for a year at Health NZ, as ‘Programme Manager, Systems Pressures’ (were those the pressures the Government brought on us?). But more significantly, in Feb this year, she was appointed ‘Head of Clinical’ for the Ultimate Care Group.

Now let’s just clarify that this is not a dig at Lucy Adams or any other individual who may or may not think they are doing a great job. Nor is it any comment on the service or level of care provision by anyone or at any particular residential care facility (or similar).

Instead, in the spirit of seeking to expose some of the missing transparency (and hoping eventually - optimistically - for some accountability) for what has been done to us by these tyrannical lockstep governments over recent years, I wanted to point out these facts about the retirement home industry in NZ. So I’ve summarised above how there is intense propaganda that encourages retirees to sign up to what could lead to financially devastating consequences. How the reality of daily essentials like food and nutrition at these institutions can be unacceptable. How staff are not vetted appropriately, putting elderly residents at risk. The Retiree Exploitation Industrial Complex is growing exponentially and we need to raise awareness amongst our families of the many hidden dangers.

And Finally…

I don’t need to go over again the NZ Government’s ‘Covid National Response’, or how it came to pass, as lots of us have already written about that, and the people involved (see my previous posts). We know that part of that ‘response’ meant that all elderly care home staff and residents had to be double or triple- injected, either as part of the ‘Vaccine Order’ for healthcare workers, or when patients’ informed consent was overruled because of the so-called ‘emergency’. And lots of financial incentives were on offer for those who promoted the jabs.

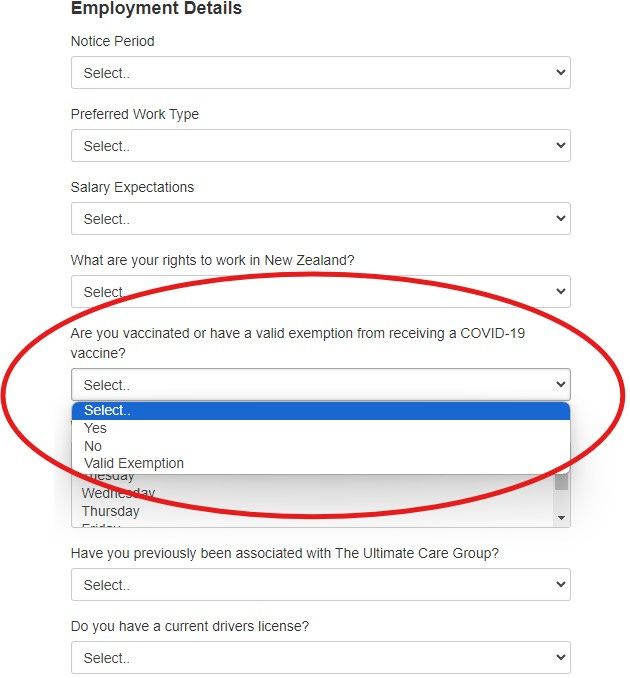

In curiosity, I looked-up some vacancies for one of the retirement homes Lucy Adams in in charge of at Ultimate Care Group. Sure enough, even though the Vaccination Order Mandates ended in 2022, they still apparently require all new staff - including a ‘Casual Caregiver’ to be ‘fully vaccinated’. Here’s a screenshot from their Job Application Form:

The mind boggles. Before posting this, I emailed last week to ask them if this was still valid and what was the rationale for this job app criteria? No response.

When things go wrong with these retirement agreements some people will be relieved there is a regulator. But I’ve written recently about the Commerce Commission, one of the Quangos in NZ. Taxpayers’ money is used to fund this already bloated pseudo-independent entity and maybe the Retirement Commission is the same? There’s another rabbit hole ahead…

Thank you for this article. My Dad developed rapid-onset dementia after his booster. We won't be going anywhere near those 'homes' or 'villages.' We will take care of him ourselves (as we did with our grandparents). I wish that was the dominant model in society (although I know it is just not possible for many families).

Regarding the vaccine requirements - I tried to volunteer as a driver for the Cancer Society a couple of weeks ago. Rejected, because I didn't get two shots of an experimental gene therapy three years ago. Oh the irony of being rejected by the cancer society for not taking an intervention that would increase my cancer risk!

Wonderful research and writing Ursula and as we all now know , the tip of yet another iceberg in the sea of usury .

Blessings and appreciation from Sydney.