Reserve Bank of New Zealand wants to help rural retailers bank their cash

Rural communities may gain a new ATM, but is this offer genuinely encouraging cash transactions? Let's dig a little!

I was contacted by a few local residents recently, excited about the prospect of getting an ATM in our village. After all, local branches of the main banks are at least ten minutes drive away and some have already closed. We are all keen to use more cash, aren’t we. Call me sceptical (really, I’m an optimist at heart), but this was immediately suspicious.

So this short post is about the reality of the kind offer from those wonderful caring people at our Reserve Bank of New Zealand (RBNZ).

Let’s be clear, Official Information Act (OIA) responses have already confirmed how RBNZ has already made significant steps towards introducing a Central Bank Digital Currency (CBDC) and all that comes with it. In fact, they seem to have appointed a strategic senior exec management team to oversee that implementation, including ex-banker and Digi-ID specialist, John Baddiley.

The RBNZ have announced a new Pilot Research Study that will be:

“…trialling new ways to help retailers bank takings and get change in rural communities lacking over-the-counter bank or ATM cash services. We're also ensuring their customers can readily get cash-outs with or without purchase.”

Note this is centred on encouraging shops to bank their cash, it is not about helping the public. They continue…

We’re contracting cash handling equipment, cash service, security, and research partners to help us deliver and assess the trials.

We’ll also arranging with (sic) payment switches which process card transactions between retailers, card companies and banks to provide us with data so that we can pay retailers for cash-outs and monitor payment trends in the trial communities.This data won’t include identifying bank account or card details. (author: of course not!)

Clearly this is a data harvesting exercise. My immediate attention was drawn to the ways that any community group can learn more about the project - oh goodie, through a Microsoft Teams hosted webinar.

And apply to take part in the project - even better, through the NZ Gov ‘RealMe’ digital identity system that links things like your passport, immigration status, drivers licence and income tax details together in one ‘convenient’ package.

Oh boy.

Current currency

At the moment, a member of the NZ public can easily get cash out at a local retailer, usually providing they buy something. Easy as. But this new service (running over 18 months) could also be …

“…providing local cash deposit and change withdrawal facilities for retailers, or other retailer-focused arrangements…”

The public are already low on the priority list as bank customers, so a focus on retail is predictable. And it could be useful for RBNZ’s CBDC plans. But where is the research supporting the RBNZs approach? Rather than helping bank branches to stay open in towns, this could effectively reduce their use, by cutting-out the requirement to visit a branch to bank the cash rural retailers have taken.

This type of system is already in use here in terms of the Post Office. Like the UK, many rural post offices were closed, in favour of ‘cost effective’ moves into local retailers where staff would need to learn more skills for no new money. My understanding is that there isn’t even a rebate to these NZ retailers for taking on this responsibility (?)

I can’t imagine many communities will apply, bearing in mind the process, or perhaps the ‘lucky’ communities have already been chosen, and this is just a facade?

“Applicants should be, or be acting on behalf of, town leaders which may include organisations or individuals from an iwi or hapū; local government (city/district council or community board); retail, business, economic development or community groups. Applications must be formally endorsed by up to 3 other leaders, such as listed immediately above.”

I can only dream about any Kiwi community that would be able to pull this enormous diplomatic feat together! But apparently RBNZ tell us many communities have already ‘expressed an interest’.

I bet they have.

Small Print

But let’s take a moment to look into exactly what the RBNZ are saying here and what it might be up to (I think we can guess). To its credit, they seem to saying the right things:

Apparently, RBNZ claim New Zealanders “aren’t using cash as much now” (2 mins):

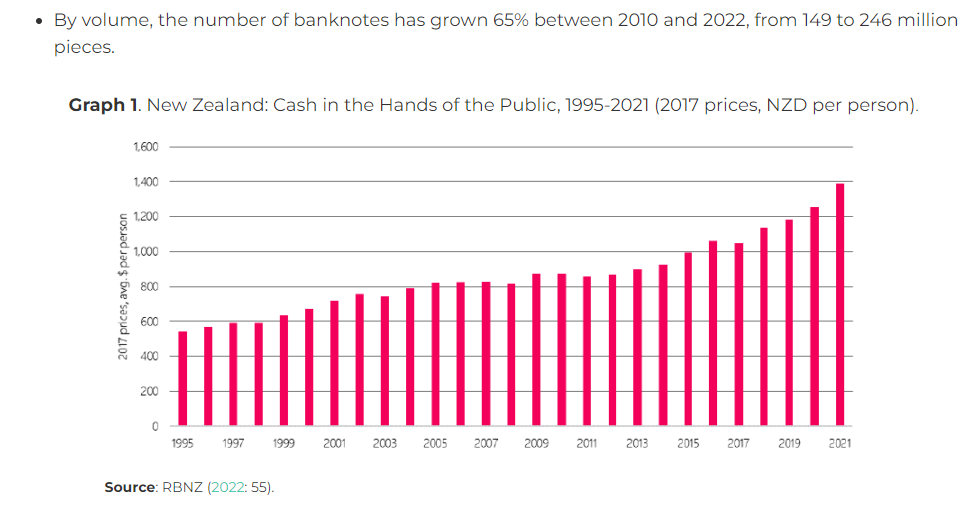

But actually, we know that use of cash has INCREASED recently, lots of different sources have confirmed that. For instance cash in the hands of the public (not necessarily used in Gov or at retailers):

And here was an article from the Government after a cyclone hit NZ advising residents to ensure they had a supply of cash in an emergency.

Others have pointed out the contradictions too, for instance here:

We know anecdotally that many people ‘in the know’ are trading more in cash, keeping reserves of all kinds of currencies and heavy metals and bartering items, planning for a rainy day. But RBNZ may not know about that.

So what makes the RBNZ claim that ‘less people are using cash’?

Tell a Lie, Tell a BIG Lie, Tell it FIRST, Keep repeating it.

This RBNZ lie results from some ‘research’ RBNZ published when it supposedly investigated how ‘changes in cash usage and payment methods over time’. As I have gotten used to when reading NZ Gov-funded research, the methodology looked dubious. It begins with:

“We surveyed adults aged 18 years and over who normally reside in New Zealand, mailing our survey to a sample drawn from the electoral rolls with respondents able to complete it online or by post.”

It was interesting to note these three findings which if investigated further, could contradict RBNZs claims about reduced cash use:

People who reported using cash more than seven times in the past seven days increased significantly to 8.3% in 2023 from 5.6% in 2021.

There was a significant increase in respondents reporting privacy and safety concerns as drivers of cash use in 2023 when compared to 2021.

The percentage of people storing cash somewhere other than their bank accounts increased significantly to 56.4% from 47.3% in 2021. The main reasons for storing cash were “for emergencies”, “to be able to quickly get money when they need it”, and “to feel better prepared for the unknown”.

The RBNZ is reporting differences between the various past surveys when they are calculated as ‘statistically significant’. But there are some problems with its approach. The 2021 survey for instance, was conducted during covid lockdown, and being mailed out to participants selected via the census, there are likely to have been dramatic differences during that time to people’s location, employment, access to cash, their use of cash and purchases made.

I’m not sure how on earth those survey results can in any way resemble an appropriate comparison to 2023?

This is compounded by the fact that in 2021 only 3,107 people responded (despite what looks like numerous attempts to contact those who had been invited). In 2023, a total of only 2,881 people responded. Oh dear. Not a huge number to start making generalisations about cash use by the whole of the ‘team of five million’? If you are a Kiwi, when was the last time you took part in a Gov survey?

As the RBNZ wrestles with the narrative about the inevitable global recession hitting NZ, in light of the forthcoming review of the Official Cash Rate, those struggling to pay their mortgage may be pleased that we can all still access cash. Use it or lose it.

So in conclusion, the RBNZ looks like it’s on a fishing expedition about the use of cash by retailers, that will provide some more opportunities for it to harvest data from both rural retailers and citizens interested in using cash.

RBNZs offer seems disingenuous when seen in the context of the research it presents. Any claims made are based on outputs from a batch of flawed survey responses over 4 years (some of which were during lockdowns) from a small sample of the NZ public. Perhaps not a particularly representative sample, either. RBNZ did not survey retailers. Or perhaps they did, but these were not included in the information provided to potential applicants.

We are left with questions like: Should the RBNZ be encouraging retailers to become pseudo-branches of local banks? How will the data gained from this exercise be used (against us)?

Maybe we’ll find out more in due course.

It's very scary stuff ... can we trust 'our' banks ... the evidence would suggest no ...

Can we trust our Reserve Bank?

I don't know ...

Who owns our Reserve Bank? The Fed is privately owned ... but who pulls Orr's strings ...

Several years ago ... Don Brash blocked me when I asked questions ... why don't they like questions?

I think digital currency is inevitable ... but we need some sort of charter to protect cash ...

But I think they are going to completely collapse the World's economy ... take us into a very deep depression ... among other devastation ... weaken people to the point they are wiped out ... and begging for handouts ... and that will be the point that 'social credit' becomes the over-riding control mechanism ... welcome to 'serfdom' ...

Unless people wake up ... pretty much ... right now ... they are headed for a very bleak Orwellian future ... but with optimistic people ... like you Ursula ... who have a 'magic touch' with their community ... I think there is still hope ... as today's legal 'threats' to the WHO prove ... good people are fighting back ...

Your optimism and 'magic touch' ... gives me optimism Ursula ...

Thank you ... and on behalf of everyone your 'optimistic magic' touches ... please keep it up ...

regards

pb

I should add the RBNZ have 'consultation' webinars on this. I've been on one. Asked a technical question and got a very surprising answer. Wont go into it here, but you might be interested in doing same. Go to bottom for times. Would do more on this if health was up to it; very frustrating because I think this is the most important issue -- among very many I know.

https://consultations.rbnz.govt.nz/money-and-cash/digital-cash-in-new-zealand/